- +91 8409051265

- support@earnbook.in

- plot no 143 ,New Mainpura, kharanja road new shiv mandir , Danapur patna

The No.1 Aadhaar Enabled Payment System (AePS)

Delivering Exceptional AePS Services

AePS Services are Aadhaar-based banking facilities that let customers carry out financial transactions using their Aadhaar number as the main identifier instead of cards or account numbers.

With AePS, a network of local EarnBook partners can deliver critical banking services to customers in rural and semi‑urban regions, helping drive true financial inclusion across the country.

- Makes money transactions easy with an intuitive, user‑friendly interface.

- Uses Face Authentication, fingerprint, or IRIS scan for verification

- Supports Underserved Communities

- Keeps bank account details hidden during transactions

- Offers a range of commission structures so partners can choose what fits them best

Loan Centre with EarnBook

Access fast and convenient business loans through EarnBook’s fully assisted Loan Centre. Begin by checking your credit profile to understand your eligibility and instantly view curated loan offers from multiple trusted lending partners, all in one place.

Enjoy a 100% digital, paper‑light journey with quick approvals, minimal documentation, and hassle‑free disbursals directly to your bank account. As an EarnBook partner, you can also facilitate loans for your customers and earn up to 1% commission on every successful disbursement, creating an additional income stream.

Track every application in real time using the Disbursal Tracker, which shows live status updates from login to payout, so you and your customers always know exactly where the loan stands. With EarnBook’s Loan Centre, getting and distributing business loans becomes simpler, faster, and more transparent—helping you and your customers move one step closer to financial growth.

Retailer & Customer (Grahak) Loan

EarnBook provides tailored loan solutions for both retailers and their customers to handle urgent or planned expenses such as medical treatment, education fees, home repairs, or lifestyle upgrades. Each loan comes with flexible amounts and tenure options, allowing users to pick EMI plans that are comfortable and sustainable.

-

-

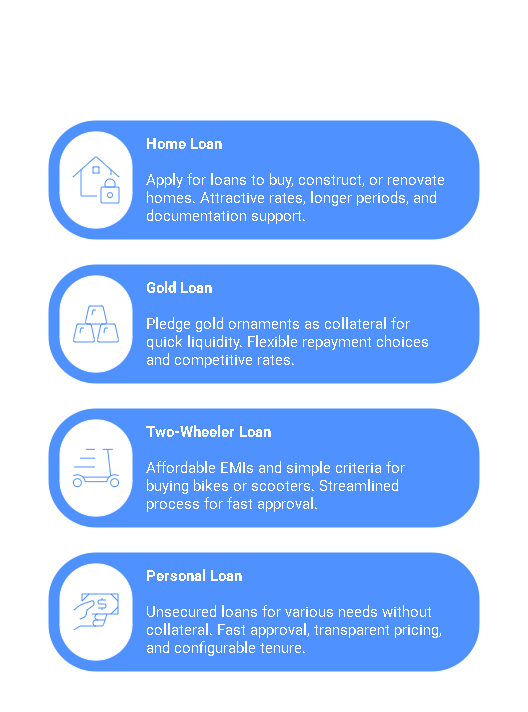

EarnBook, through its lending partners, offers a complete suite of loan solutions to cover both personal and business‑related needs with flexible terms and a largely assisted, low‑paperwork journey.

With home loans, customers can finance the purchase of a new property, construct a house, or renovate an existing home, supported by attractive interest rates, longer repayment tenures, and help with documentation so that owning or upgrading a home becomes more attainable. Gold owners can unlock instant liquidity through gold loans by pledging their jewellery as collateral and receiving funds quickly, while still enjoying competitive rates and convenient repayment options without having to sell their assets.

For everyday mobility needs, EarnBook’s two‑wheeler loans make buying a bike or scooter easier through simple eligibility criteria, affordable EMIs, and a streamlined approval flow that reduces documentation and speeds up disbursal. In addition, unsecured personal loans are available for diverse purposes such as travel, weddings, medical emergencies, education, or lifestyle expenses, combining fast approval, transparent pricing, and configurable tenures so customers can borrow and repay in a way that fits their financial comfort.

-

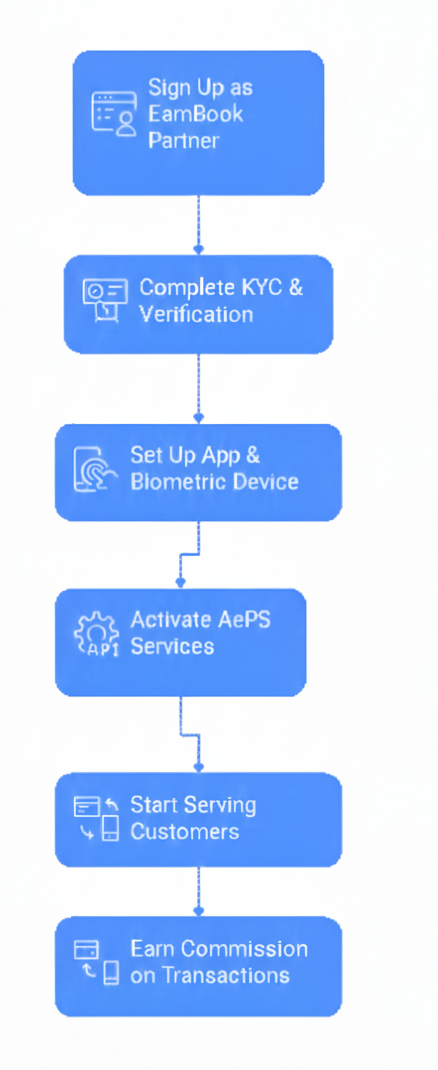

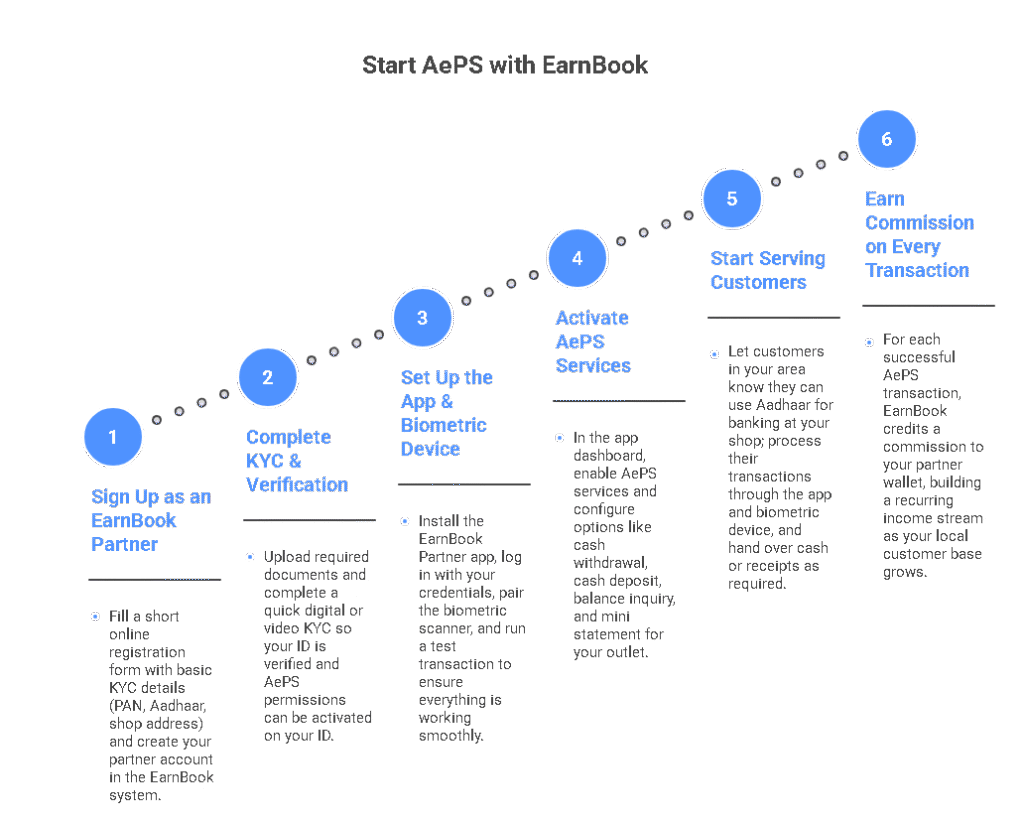

Start AePS with EarnBook