- +91 8409051265

- support@earnbook.in

- plot no 143 ,New Mainpura, kharanja road new shiv mandir , Danapur patna

The No.1 Aadhaar Enabled Payment System (AePS)

Delivering Exceptional AePS Services

AePS Services are Aadhaar-based banking facilities that let customers carry out financial transactions using their Aadhaar number as the main identifier instead of cards or account numbers.

With AePS, a network of local EarnBook partners can deliver critical banking services to customers in rural and semi‑urban regions, helping drive true financial inclusion across the country.

- Makes money transactions easy with an intuitive, user‑friendly interface.

- Uses Face Authentication, fingerprint, or IRIS scan for verification

- Supports Underserved Communities

- Keeps bank account details hidden during transactions

- Offers a range of commission structures so partners can choose what fits them best

Account Opening

EarnBook partners provide a wide range of banking services designed to drive financial inclusion, including opening new bank accounts for customers in their locality. By using EarnBook’s distributed network of outlets, partners make account opening simple and accessible, guiding users through KYC and onboarding with minimal paperwork.

This ensures that people in remote, rural, and underserved communities can easily start their banking journey and gain access to savings, payments, and credit products, supporting long‑term financial inclusion and economic empowerment across diverse segments of society.

NSDL – Account Opening with EarnBook

Open an NSDL-linked account through EarnBook and enjoy a smooth, fully assisted onboarding journey with near‑instant account creation and a convenient starter kit that includes a welcome letter and debit card. This process is designed with minimal paperwork, so setup is quick and hassle‑free for customers in both urban and remote locations.

Benefit from dedicated customer support for query resolution and day‑to‑day assistance, while enjoying the comfort of zero minimum balance requirements for greater flexibility in managing your money. You can also easily link your Aadhaar to the account for seamless verification and service access, and use nearby EarnBook partner outlets to perform cash withdrawals and deposits, making everyday banking simple and accessible.

Key Highlights

-

-

Higher Commissions

Earn competitive payouts on AePS, mATM, bill payments, account opening, and other services, helping partners grow their income with every transaction. -

Zero Balance Account

Enjoy the flexibility of operating with no minimum balance requirement, which is ideal for individuals and small merchants managing variable cash flows. -

Paperless Documentation

Benefit from a largely digital, paper‑free journey using e‑KYC and electronic forms, reducing manual paperwork and speeding up approvals.

-

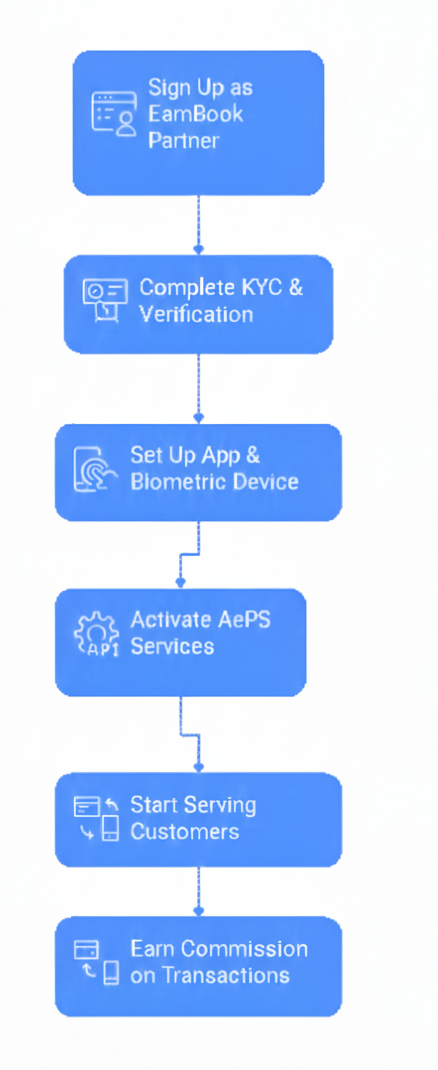

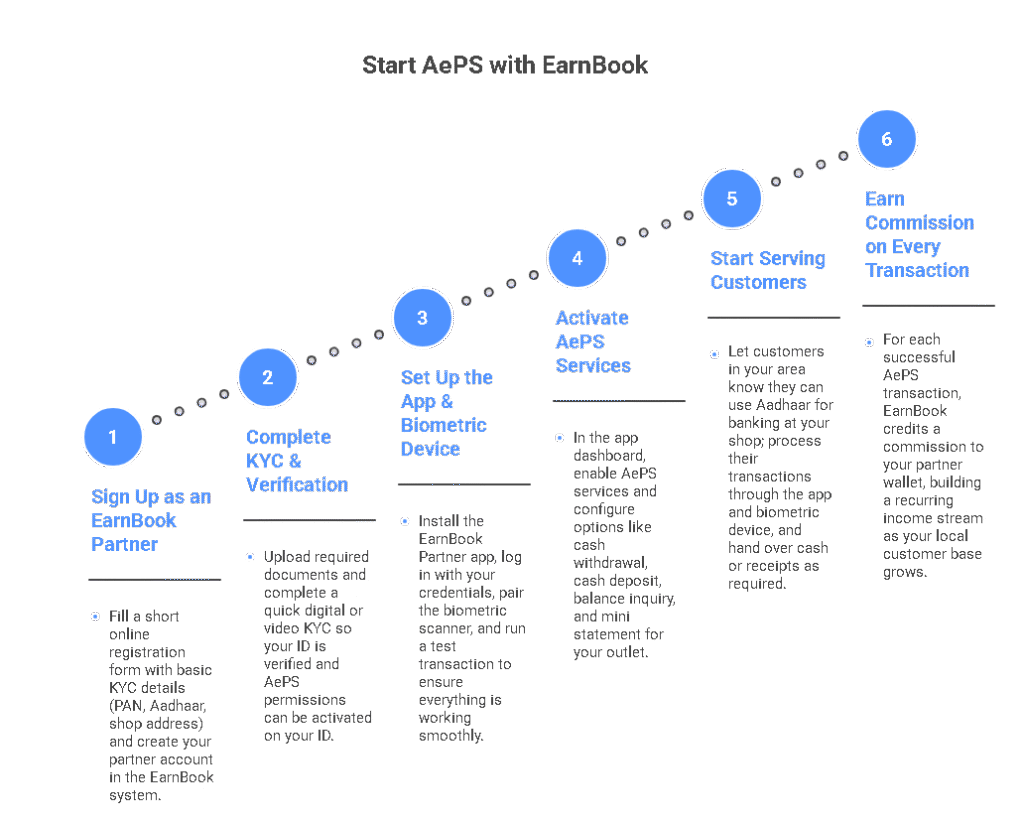

Start AePS with EarnBook