- +91 8409051265

- support@earnbook.in

- plot no 143 ,New Mainpura, kharanja road new shiv mandir , Danapur patna

The No.1 Aadhaar Enabled Payment System (AePS)

Delivering Exceptional AePS Services

AePS Services are Aadhaar-based banking facilities that let customers carry out financial transactions using their Aadhaar number as the main identifier instead of cards or account numbers.

With AePS, a network of local EarnBook partners can deliver critical banking services to customers in rural and semi‑urban regions, helping drive true financial inclusion across the country.

- Makes money transactions easy with an intuitive, user‑friendly interface.

- Uses Face Authentication, fingerprint, or IRIS scan for verification

- Supports Underserved Communities

- Keeps bank account details hidden during transactions

- Offers a range of commission structures so partners can choose what fits them best

How Aadhaar Enabled Payment System (AePS) Works

- Open the app and sign in with your credentials.

- Go to the AePS section and choose the required service: Cash Withdrawal, Cash Deposit, Mini Statement, or Balance Inquiry.

- Connect the biometric authentication device to your phone or terminal.

- Enter the customer’s mobile number and Aadhaar number in the respective fields.

- For withdrawal or deposit, type in the transaction amount and select the customer’s bank name from the list.

- Ask the customer to provide fingerprint (or other supported biometric) on the device and submit the request.

- Wait for the confirmation message on screen; once approved, the transaction is completed successfully and a receipt/notification can be shared with the customer.

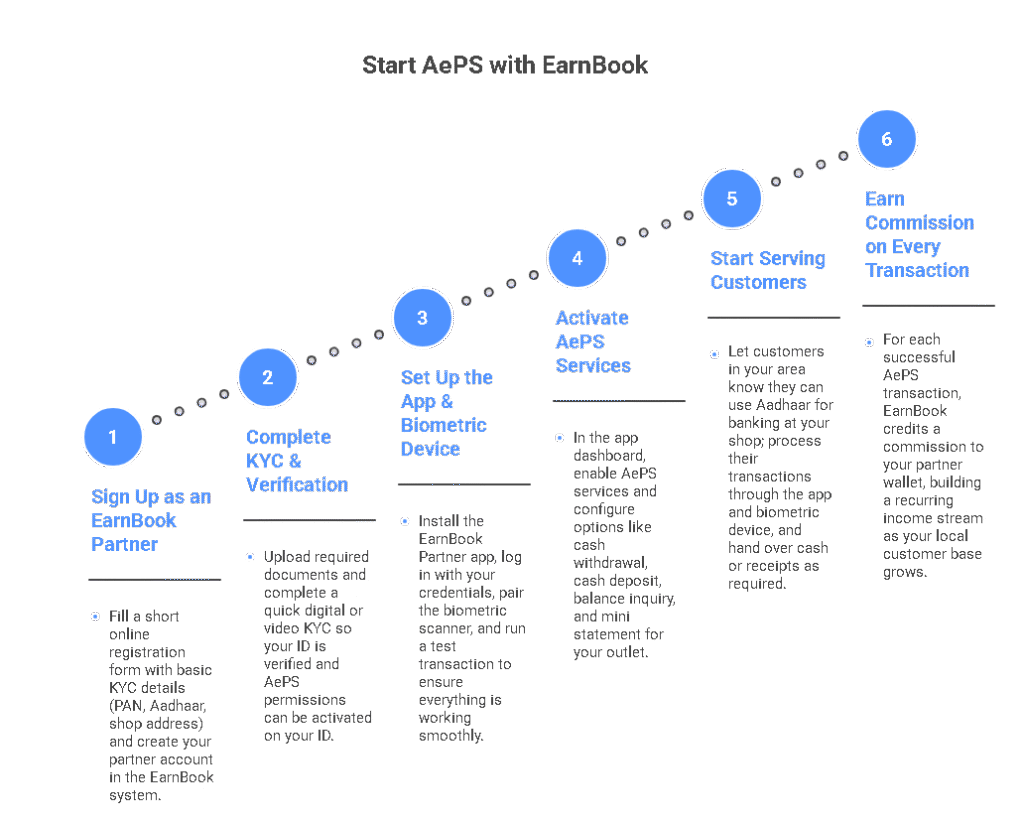

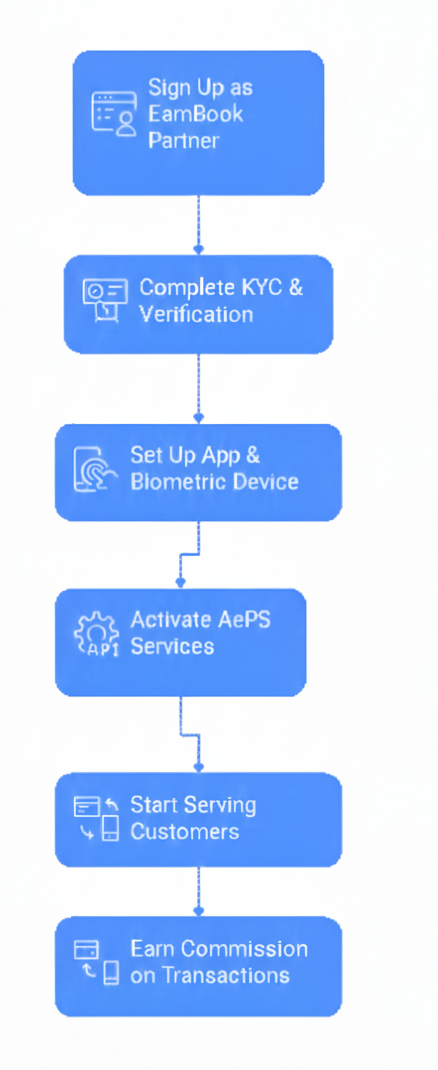

Start AePS with EarnBook

FAQ's

What does AePS cash deposit mean with EarnBook?

It lets customers deposit cash into their bank account at an EarnBook outlet using Aadhaar and fingerprint/biometric instead of a deposit slip or card.

How does AePS cash withdrawal work on EarnBook?

Customers visit an EarnBook partner, share Aadhaar, choose their bank and amount, authenticate biometrically, and receive cash once the bank approves.

What is the process for AePS cash withdrawal with EarnBook?

Select AePS withdrawal in the app, enter Aadhaar and bank, add the amount, take the customer’s fingerprint, and on success give cash plus a receipt or SMS.

Why choose EarnBook for AePS services

Some services like cash withdrawal or deposit may have a small fee, while balance inquiry or mini statement is usually free or very low cost.

What if an AePS transaction fails on EarnBook?

Note the transaction ID, do not immediately retry, and contact the EarnBook outlet or support; in most cases the bank completes or reverses it automatically.

What are mini statement and balance inquiry in EarnBook AePS?

Balance inquiry shows current account balance, while mini statement lists a few recent transactions for quick account tracking.

Which banks work with AePS on EarnBook?

Most major public, private, and regional rural banks that support NPCI’s AePS and are Aadhaar‑linked can be used through EarnBook outlets.