- +91 8409051265

- support@earnbook.in

- plot no 143 ,New Mainpura, kharanja road new shiv mandir , Danapur patna

Domestic Money Transfer (DMT) with EarnBook

Domestic Money Transfer (DMT) with EarnBook lets customers send money to any bank account in India quickly and safely through nearby EarnBook partner outlets. Instead of using net banking or standing in bank queues, users can walk into a local EarnBook point, hand over cash, and have it credited to a beneficiary’s account in just a few steps.

At the outlet, the partner enters the receiver’s details—name, account number, bank and IFSC—along with the transfer amount in the EarnBook app, then submits the transaction over secure banking rails. The funds are routed via approved channels such as IMPS or NEFT, so they typically reach the recipient either instantly or within a short processing window, depending on the mode used.

This setup makes digital remittances accessible for people who may not use smartphones, UPI, or internet banking, particularly in rural and semi‑urban areas. At the same time, EarnBook partners earn commission on every successful transfer, turning their shop into a convenient mini‑remittance centre while extending formal banking services deeper into the community.

How Does It Work?

- Visit your nearest EarnBook partner outlet.

- Share the recipient’s bank account details and the amount you want to send with the EarnBook partner.

- The partner starts the transfer from the EarnBook agent app, entering the details you’ve provided.

- The money is sent almost instantly to the recipient’s bank account through secure banking channels.

- You receive an on‑screen / SMS confirmation so you have a clear record of the transaction

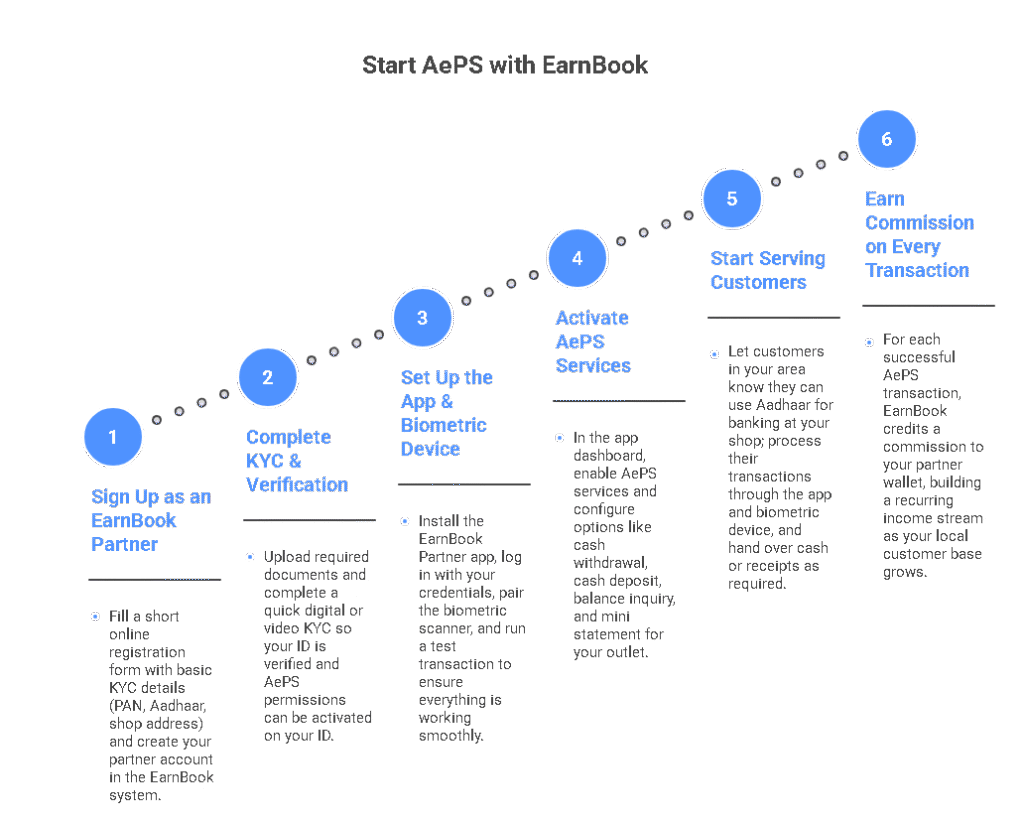

Start AePS with EarnBook

FAQ's

What is Domestic Money Transfer (DMT) with EarnBook?

Domestic Money Transfer with EarnBook is a service that lets you send money in cash from a nearby EarnBook partner outlet to any bank account within India. The agent uses the EarnBook app to process the transfer and the amount is credited directly to the recipient’s bank account.

How can I start a money transfer business with EarnBook?

You can become an EarnBook partner by completing a simple registration and KYC process, after which you get access to the EarnBook agent app. Once activated for DMT, you can start sending money on behalf of customers and earn commission on every successful transaction.

How do I transfer money from one bank to another using EarnBook?

Visit an EarnBook outlet, share the recipient’s name, account number, bank name, IFSC code, and transfer amount with the agent. The agent enters these details in the EarnBook app, confirms them with you, and submits the request; the funds are then sent through banking rails like IMPS/NEFT to the beneficiary’s account.

Are there any fees for using EarnBook’s domestic money transfer service?

Yes, a small service fee is usually charged per transfer, based on the amount and slab. This fee is shown to you before the transaction is confirmed, so you always know the exact cost in advance.

How long does it take for the money to reach the recipient’s bank account?

Aadhaar is not always mandatory for DMT; basic details like sender mobile number and valid ID as per KYC rules are usually sufficient. However, some limits or additional checks may apply if full KYC, including Aadhaar, is not completed.

Do I need the IFSC code of the recipient’s bank for a transfer?

Yes, for account‑to‑account transfers you generally need the recipient’s IFSC code along with the account number. The agent can help you find the correct IFSC from the bank and branch details if you are unsure.

Will I get a receipt or confirmation after the transaction?

After every DMT transaction, the EarnBook agent app generates an on‑screen confirmation and a digital receipt. You can receive this as an SMS/WhatsApp message or printed slip, which includes the reference number and amount sent.

Is there a limit on how many transfers I can do in a day?

Yes, daily transaction limits apply based on regulatory guidelines and EarnBook’s internal risk policies. These limits may include both per‑transaction caps and total daily transfer ceilings; your agent can inform you of the current limits at the time of transfer.